The Future of IT in Banking (2023)

IT in banking is expected to play a key role in transforming this industry in the next decade, as it can help banks to provide better services, improve efficiency, reduce costs, and foster innovation. IT can also enable banks to reach more customers, especially those who are underserved or unbanked by traditional financial institutions.

That is the reason why the future of IT in banking is a topic that has attracted a lot of attention from various experts and stakeholders.

Let’s expose some points of view in this article!

1. How IT in Banking help organization

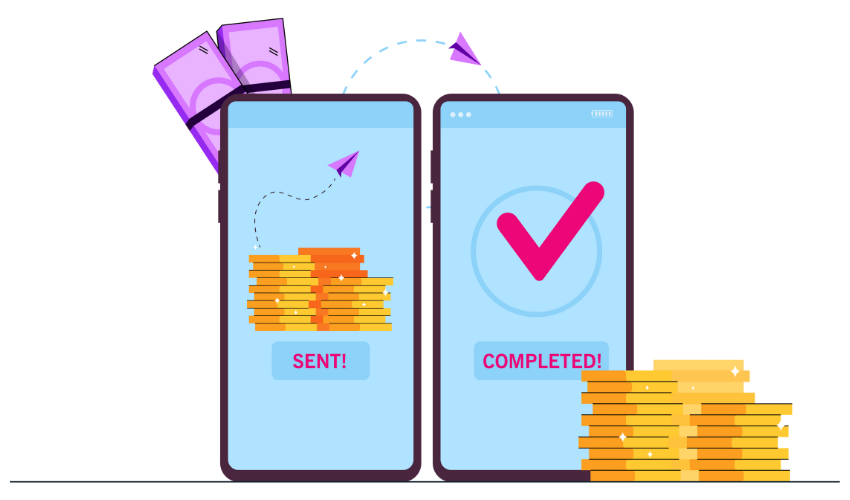

• Improve the access and affordability of financial services for the unbanked and underbanked populations, especially in developing countries. Customers are allowed to send and receive money, pay bills, and save using their phones without a physical bank card.

• Enhance the customer experience and satisfaction by offering more personalized, convenient, and transparent services. For example, in banking apps, they are providing automated investment advice, saving plan or portfolio management based on the customer's goals, risk preferences, and financial situation.

• Increase the efficiency and productivity of banking operations by automating and streamlining manual, repetitive, and complex tasks.

• Foster innovation and competition in the banking sector by lowering the barriers to entry and creating new markets and business models. For example, peer-to-peer lending platforms connect borrowers and lenders directly, bypassing traditional banks and offering lower interest rates and fees.

2. A brief development of IT in banking in current 10 years

IT in banking has evolved significantly in the last 10 years, as banks have adopted various technologies to provide better services. Some could be named:

• Mobile and digital banking

Banks have developed mobile apps and websites that allow customers to access their accounts, make payments, transfer money, and get financial advice anytime, anywhere, and on any device. Mobile and digital banking have become the preferred methods for customers to interact with their banks, especially after the COVID-19 pandemic.

• Artificial intelligence (AI)

Banks have used AI to automate and streamline manual, repetitive, and complex tasks, such as processing transactions, documents, and data. AI has also helped banks to enhance customer experience and personalization, by offering tailored products, services, and recommendations based on customer preferences and behavior. AI has also enabled banks to detect fraud, manage risk, and comply with regulations.

• Open banking and digital platforms

Banks have adopted open banking and digital platforms to allow customers to share their financial data and access financial services from multiple providers through a single platform. Open banking and digital platforms have increased customer choice, convenience, and value. Open banking and digital platforms have also helped banks to reach new customers, create new revenue streams, and enhance customer loyalty.

3. Trend of IT in banking in 2023

Some of the trends and technologies that are likely to shape the future of IT in banking are:

• Mobile and digital banking

Of course, this would remain. Banks need to offer more convenience, personalization, and security to their customers through mobile apps, biometrics, artificial intelligence, and big data analytics, which can be well-supported by digital solutions.

• Banking-as-a-Service (BaaS) and embedded finance

BaaS is a model that allows banks to offer their services to third-party platforms, such as e-commerce sites, social media platforms, or other fintechs. Embedded finance is a model that allows non-financial businesses to offer financial services to their customers through their own platforms. These models can help banks to reach new customers, create new revenue streams, and enhance customer loyalty.

• Blockchain

Blockchain is a technology that enables secure and fast transactions without intermediaries or central authorities. These technologies can help banks to reduce transaction costs, increase transparency, and offer new products and services, such as cross-border payments, remittances, and digital wallets.

• Cloud computing and robotic process automation (RPA)

Cloud computing is a technology that allows banks to store and access data and applications over the internet. RPA is a technology that allows banks to automate and streamline manual, repetitive, and complex tasks. These technologies can help banks to improve their operational efficiency, scalability, and agility.

4. Challenges of IT in banking

It is a fact that banks also faces to some challenges when applying IT, which requires them to be aware:

• Disaster recovery and security strategies

Banks need to ensure the safety and compliance of their data, which can be difficult and time-consuming. It is essential to protect their systems from cyberattacks, data breaches, or system failures that can compromise their operations and reputation.

• Regulatory compliance

Banks need to comply with various laws and regulations that require accurate and timely reporting and auditing. These regulations can be restrictive and complex, and they can vary across different jurisdictions..

• Increasing competition

Banks directly face competition from FinTechs, because FinTech businesses offer alternative and cheaper financial solutions. They target some of the most profitable areas in financial services, such as mobile payments, peer-to-peer lending, robo-advisors, blockchain, cryptocurrencies, artificial intelligence, big data analytics, and more.

With the significant development of IT in banking these years, decision makers should be aware of both the pros and cons to well adapt it into organizations.

FINAL THOUGHT

If you are looking for a trusted IT partner for IT outsourcing in banking solutions, VNEXT Global is the ideal choice. With 14+ years of experience, we certainly can help you to optimize your business digitalization within a small budget and a short time. With a customer-centric approach, we provide effective and transparent communication, timely and reliable support. Currently, we have 400+ IT consultants and developers in Finance, Healthcare, Mobile App, Web App, System Development, Blockchain Development and Testing Services. We have provided solutions to 600+ projects in several industries for clients worldwide. We are willing to become a companion on your way to success.

Please feel free to drop us an email when it is convenient for you to have an online meeting to discuss this further. Have a productive day!