Author: Chi Vo

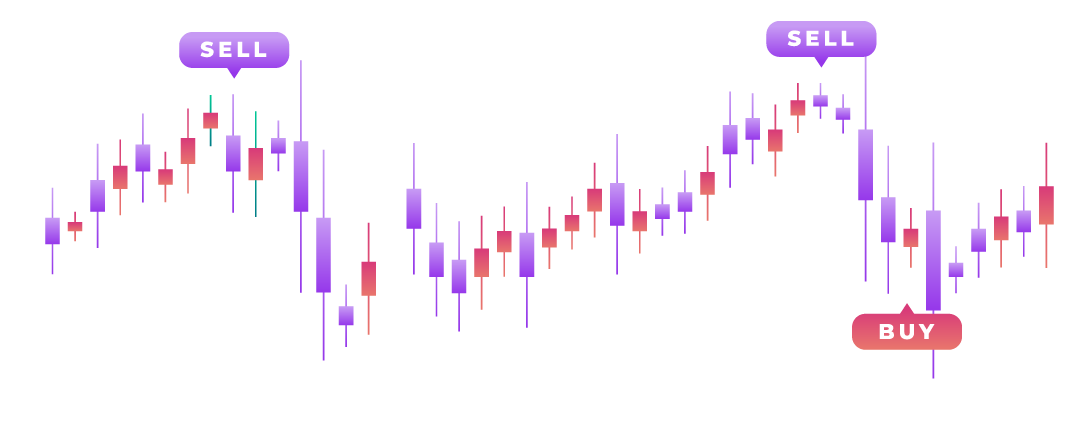

The banking industry has withstood a momentous transformation over the last decade, with the rise of digital technology leading the charge. Gone are the days of having to wait in line at a physical bank, or even worse, having to send checks via mail. Now, with just a few taps on a smartphone, customers can manage their finances, make transactions, and even apply for loans.

A report by Vantage Market Research found that the Global Mobile Banking Market had a value of USD 692.5 Million in 2021 and is anticipated to reach USD 1,359.5 Million by 2028. Over the projection period, the Global Market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 11.9%. This growth can be attributed to the upward trend of digital technology in the banking sector, allowing for a more convenient and comprehensive banking experience for customers.

In this blog, we will dive deeper into the world of digital banking transformation and explore its impact on the industry. We will go through some examples of digital transformation in the banking sector and analyze its strengths, weaknesses, opportunities, and threats (SWOT). Lastly, we will explore how businesses can take advantage of the digital banking transformation to improve their financial management and stay ahead of the curve.

So, buckle up and get ready to learn how the world of banking has changed and where it is headed in the future.

Digital Banking Transformation: How Modernization Changed Banking?

1. What precisely is digital banking transformation?

Digital banking transformation refers to the process of modernizing traditional banking methods and systems through the use of technology. To automate banking processes and offer innovative financial services, involving the use of leading-edge technologies such as:

- Artificial intelligence

- Machine learning

- Big data

- Blockchain

- Cloud computing

Digital banking transformation has allowed customers to check their digital banking account balances, transfer money, and pay bills without having to visit a physical branch. Additionally, banks are now able to offer their customers a range of new services, such as mobile check deposits, person-to-person (P2P) payments, and financial planning tools.

For example, JPMorgan Chase, one of the largest banks in the US, has made major investments in digital technology in the present day and age. They have launched several mobile banking apps that allow customers to deposit checks, pay bills, transfer money, and access account information from their smartphones. The bank has also implemented AI-powered chatbots that assist customers with account-related inquiries and provide personalized financial advice.

.png)

2. Why digital banking is the future?

Digital banking is rapidly gaining traction and it's no secret that it's set to be the future of financial services. The traditional banking model is becoming obsolete as people are demanding more convenient and efficient ways to manage their finances.

First and foremost, consumers are increasingly demanding a more convenient, user-friendly banking experience. With the rise of technology, people are used to being able to access information and services quickly and easily through their smartphones and other devices. This has led to a growing expectation that banks should provide similar levels of accessibility and convenience. In fact, a survey by Accenture found that 67% of customers would be more likely to switch banks for a better digital experience.

In addition, online digital banking has become surprisingly important in order to stay competitive. With the entry of new players in the market as fintech startups, traditional banks are under increasing pressure to adapt to new technology in order to retain their customers. These new players have been able to disrupt the traditional banking model by leveraging technology to offer faster, more convenient services. In order to stay ahead of the curve, traditional banks have been forced to embrace digital transformation in order to stay relevant.

Finally, technological advancements have enabled banks to offer new and innovative services to their customers. For example, the use of artificial intelligence and machine learning has allowed banks to provide more personalized services, such as customized investment advice. Additionally, blockchain technology has made it possible to streamline banking processes and reduce costs, making it easier for banks to provide services to customers in remote or underserved areas.

.png)

3. How has digitalization changed banking?

Digitalization has changed banking in many ways. On the one hand, it has brought about significant improvements in efficiency, speed, and convenience. Banks are now able to process transactions faster, provide more personalized services, and reduce costs. By reducing the need for physical branches and reducing the time and resources required for manual processes, banks can optimize their operation with a less costly approach. This has allowed them to pass on these cost savings to their customers, either through lower fees or by offering higher interest rates on savings accounts.

On the other hand, digitalization has also created new challenges for banks, such as increased competition from fintech companies and the need to adapt to changing customer preferences and behaviors.

.png)

4. What are the strengths, weaknesses, opportunities, and threats of digital banking transformation?

For businesses to better make decisions on investing in digital banking, VNEXT Global has made a SWOT analysis of digital banking transformation:

For instance, the strengths of digital banking are numerous, including improved speed of transactions, increased accessibility for customers, the ability to offer new and innovative services, and improved customer experience. All of these factors lead to cost reductions for banks, making online digital banking a smart choice for many financial institutions.

However, there are also weaknesses to consider, such as increased competition from fintech companies, the need to adapt to changing customer preferences and behaviors, and difficulty in integrating new technologies into existing systems. These challenges must be carefully considered, especially when it comes to security concerns related to online transactions.

Despite these weaknesses, there are also significant opportunities for businesses in the digital banking industry. For example, businesses have the ability to expand into new markets, increase profitability through new services and cost savings, and improve customer satisfaction and loyalty. Additionally, the digitalization of banking allows financial institutions to gather valuable data on customer behavior and preferences, which can be leveraged to better understand their target audience.

Despite these opportunities, digital banking also faces several threats. For instance, increased regulatory scrutiny and compliance requirements pose a risk for financial institutions. Additionally, there is a potential for fraud and security breaches, which can erode customer trust in online digital banking. Finally, the risk of customer disintermediation by fintech companies and the difficulty in retaining and attracting skilled personnel are also challenges that must be considered.

5. How can digital transformation help businesses?

Here are some of the key ways in which businesses can benefit from digital banking transformation:

- Improved speed of transactions - Digital banking offers faster and more efficient transactions, which can save businesses time and money. For example, JPMorgan Chase's digital platform, QuickPay, allows for instant payments to be made 24/7, helping businesses to better manage their cash flow.

- Increased accessibility - Digital banking allows businesses to access their digital banking accounts and make transactions from anywhere, at any time. This accessibility can be especially beneficial for small businesses and startups, who may not have the resources to visit a physical bank branch regularly.

- New and innovative services - Digital banking enables banks to offer a wider range of services, such as mobile banking apps, digital wallets, and contactless payments. These new services can help businesses stay ahead of the competition and attract new customers.

- Improved customer experience - Digital banking allows for a more personalized and streamlined customer experience, which can improve customer satisfaction and loyalty. For example, Capital One's digital platform, Eno, uses artificial intelligence to provide personalized insights and alerts to customers, helping them to better manage their finances.

- Cost reduction - Digital banking can help banks reduce their costs by automating many manual processes, such as account opening and loan processing. This cost reduction can be passed on to businesses, helping them to save money on banking and operating fees.

To take advantage of these benefits, businesses need to invest in the right technology and infrastructure. This can include partnering with a digital banking provider, upgrading their existing systems, or developing their own digital platform. Additionally, businesses should be proactive in gathering and analyzing customer data to better understand their needs and preferences. By doing so, they can continue to innovate and stay ahead of the curve in the rapidly evolving world of digital banking.

.png)

Final thoughts

Ultimately, the move to digital banking has undoubtedly altered the financial sector at full steam. Indisputably, Digital banking has the potential to revolutionize the way financial institutions serve their clients by bringing about improvements in convenience, customer service, and the source of information. In a case scenario where physical branches are closing, it is evident that digital banking is the future, with the worldwide mobile banking market forecasted to reach USD 1,359.5 Million by 2028.

Gaining customer recognition and a good reputation is a difficult task due to market competition and high user expectations. Your application, on the other hand, has a potential to succeed if it has unique features, a friendly user interface, and various delivery options.

If you are looking for a trusted IT partner for your logistics company, VNEXT Global is the ideal choice. With 14+ years of experience, we surely can help you to optimize your business digitalization within a small budget and short time. Currently, we have 400+ IT consultants and developers in Mobile App, Web App, System Development, Blockchain Development and Testing Services. We have provided solutions to 600+ projects in several industries for clients worldwide. We are willing to become a companion on your way to success. Please tell us when is convenient for you to have an online meeting to discuss this further. Have a nice day!